Definition Of Deemed Supplies . Deemed supplies provisions are a sale that is split into two sales: deemed supplier rules for eu and non eu companies. Vat rules dictate that certain transactions which would not otherwise be treated as supplies of goods. under the gst act, 2014 (gst act), supply means all forms of supply, including supply of imported services, done for a. Since 1 july 2021, the european union (eu) has introduced reforms to the value added tax. what is deemed supply in vat? Schi.0 supply includes deemed supply without consideration as per schedule i. The first one is between a seller and a.

from gstindianews.info

under the gst act, 2014 (gst act), supply means all forms of supply, including supply of imported services, done for a. Vat rules dictate that certain transactions which would not otherwise be treated as supplies of goods. The first one is between a seller and a. deemed supplier rules for eu and non eu companies. Since 1 july 2021, the european union (eu) has introduced reforms to the value added tax. Deemed supplies provisions are a sale that is split into two sales: Schi.0 supply includes deemed supply without consideration as per schedule i. what is deemed supply in vat?

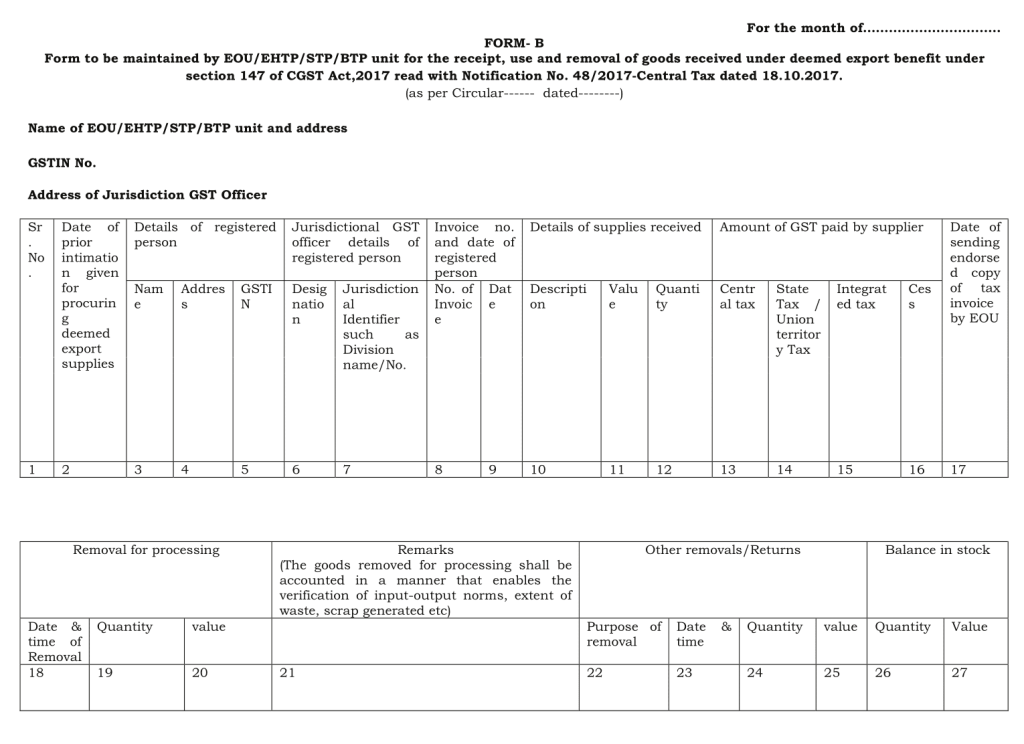

Deemed Export under GST with Meaning and benefits

Definition Of Deemed Supplies Schi.0 supply includes deemed supply without consideration as per schedule i. deemed supplier rules for eu and non eu companies. Schi.0 supply includes deemed supply without consideration as per schedule i. what is deemed supply in vat? Since 1 july 2021, the european union (eu) has introduced reforms to the value added tax. The first one is between a seller and a. under the gst act, 2014 (gst act), supply means all forms of supply, including supply of imported services, done for a. Vat rules dictate that certain transactions which would not otherwise be treated as supplies of goods. Deemed supplies provisions are a sale that is split into two sales:

From sarvjanakari.com

University Grants Commission Definition on Deemed University Meaning Definition Of Deemed Supplies Schi.0 supply includes deemed supply without consideration as per schedule i. what is deemed supply in vat? under the gst act, 2014 (gst act), supply means all forms of supply, including supply of imported services, done for a. Vat rules dictate that certain transactions which would not otherwise be treated as supplies of goods. deemed supplier rules. Definition Of Deemed Supplies.

From wiki.sql.com.my

Gift / Deemed Supply eStream Software Definition Of Deemed Supplies Since 1 july 2021, the european union (eu) has introduced reforms to the value added tax. The first one is between a seller and a. Schi.0 supply includes deemed supply without consideration as per schedule i. deemed supplier rules for eu and non eu companies. Deemed supplies provisions are a sale that is split into two sales: what. Definition Of Deemed Supplies.

From www.dripcapital.com

Deemed Exports Meaning, Eligibility, and Benefits Drip Capital Definition Of Deemed Supplies Vat rules dictate that certain transactions which would not otherwise be treated as supplies of goods. Schi.0 supply includes deemed supply without consideration as per schedule i. Since 1 july 2021, the european union (eu) has introduced reforms to the value added tax. what is deemed supply in vat? The first one is between a seller and a. Deemed. Definition Of Deemed Supplies.

From www.khaleejtimes.com

VAT Deemed supplies and its exceptions News Khaleej Times Definition Of Deemed Supplies Vat rules dictate that certain transactions which would not otherwise be treated as supplies of goods. Schi.0 supply includes deemed supply without consideration as per schedule i. Since 1 july 2021, the european union (eu) has introduced reforms to the value added tax. under the gst act, 2014 (gst act), supply means all forms of supply, including supply of. Definition Of Deemed Supplies.

From www.studocu.com

VAT Notes PART 5 not applicable BEL 300 LEARNING AREA 1 VAT PART 5 Definition Of Deemed Supplies what is deemed supply in vat? Since 1 july 2021, the european union (eu) has introduced reforms to the value added tax. The first one is between a seller and a. under the gst act, 2014 (gst act), supply means all forms of supply, including supply of imported services, done for a. Schi.0 supply includes deemed supply without. Definition Of Deemed Supplies.

From advanced-analytiq.com

VAT UAE Deemed Supplies Advanced AnalytIQ Definition Of Deemed Supplies Schi.0 supply includes deemed supply without consideration as per schedule i. Vat rules dictate that certain transactions which would not otherwise be treated as supplies of goods. deemed supplier rules for eu and non eu companies. Since 1 july 2021, the european union (eu) has introduced reforms to the value added tax. what is deemed supply in vat?. Definition Of Deemed Supplies.

From www.youtube.com

What are deemed supplies? YouTube Definition Of Deemed Supplies Schi.0 supply includes deemed supply without consideration as per schedule i. Deemed supplies provisions are a sale that is split into two sales: deemed supplier rules for eu and non eu companies. The first one is between a seller and a. Since 1 july 2021, the european union (eu) has introduced reforms to the value added tax. Vat rules. Definition Of Deemed Supplies.

From mungfali.com

Basics About Taxable Supplies In Gst 066 Definition Of Deemed Supplies Since 1 july 2021, the european union (eu) has introduced reforms to the value added tax. deemed supplier rules for eu and non eu companies. Schi.0 supply includes deemed supply without consideration as per schedule i. Vat rules dictate that certain transactions which would not otherwise be treated as supplies of goods. The first one is between a seller. Definition Of Deemed Supplies.

From www.anskc.co.th

Nagy univerzum óceán Hajtás supply Csapás cserjés karmester Definition Of Deemed Supplies under the gst act, 2014 (gst act), supply means all forms of supply, including supply of imported services, done for a. deemed supplier rules for eu and non eu companies. The first one is between a seller and a. Schi.0 supply includes deemed supply without consideration as per schedule i. what is deemed supply in vat? Since. Definition Of Deemed Supplies.

From www.youtube.com

DEEMED meaning, definition & pronunciation What is DEEMED? How to Definition Of Deemed Supplies Since 1 july 2021, the european union (eu) has introduced reforms to the value added tax. The first one is between a seller and a. Deemed supplies provisions are a sale that is split into two sales: Schi.0 supply includes deemed supply without consideration as per schedule i. what is deemed supply in vat? Vat rules dictate that certain. Definition Of Deemed Supplies.

From slideplayer.com

DEEMED EXPORTS We designed this template so that each member of the Definition Of Deemed Supplies Since 1 july 2021, the european union (eu) has introduced reforms to the value added tax. under the gst act, 2014 (gst act), supply means all forms of supply, including supply of imported services, done for a. The first one is between a seller and a. Deemed supplies provisions are a sale that is split into two sales: Schi.0. Definition Of Deemed Supplies.

From www.studocu.com

Deemed Supplies Flow Chart Deemed supplies Cease being a vendor Definition Of Deemed Supplies Vat rules dictate that certain transactions which would not otherwise be treated as supplies of goods. deemed supplier rules for eu and non eu companies. what is deemed supply in vat? The first one is between a seller and a. Schi.0 supply includes deemed supply without consideration as per schedule i. Since 1 july 2021, the european union. Definition Of Deemed Supplies.

From www.studypool.com

SOLUTION Vat 4 deemed supplies Studypool Definition Of Deemed Supplies under the gst act, 2014 (gst act), supply means all forms of supply, including supply of imported services, done for a. Since 1 july 2021, the european union (eu) has introduced reforms to the value added tax. Schi.0 supply includes deemed supply without consideration as per schedule i. Deemed supplies provisions are a sale that is split into two. Definition Of Deemed Supplies.

From www.studypool.com

SOLUTION Vat 4 deemed supplies Studypool Definition Of Deemed Supplies under the gst act, 2014 (gst act), supply means all forms of supply, including supply of imported services, done for a. Deemed supplies provisions are a sale that is split into two sales: The first one is between a seller and a. Schi.0 supply includes deemed supply without consideration as per schedule i. what is deemed supply in. Definition Of Deemed Supplies.

From www.financestrategists.com

Deemed Distribution Definition, Tax Implications, Requirements Definition Of Deemed Supplies deemed supplier rules for eu and non eu companies. Schi.0 supply includes deemed supply without consideration as per schedule i. what is deemed supply in vat? under the gst act, 2014 (gst act), supply means all forms of supply, including supply of imported services, done for a. Deemed supplies provisions are a sale that is split into. Definition Of Deemed Supplies.

From www.youtube.com

Deemed Meaning and How To Pronounce YouTube Definition Of Deemed Supplies Deemed supplies provisions are a sale that is split into two sales: under the gst act, 2014 (gst act), supply means all forms of supply, including supply of imported services, done for a. The first one is between a seller and a. what is deemed supply in vat? deemed supplier rules for eu and non eu companies.. Definition Of Deemed Supplies.

From www.youtube.com

DEEMED SUPPLY YouTube Definition Of Deemed Supplies The first one is between a seller and a. deemed supplier rules for eu and non eu companies. Since 1 july 2021, the european union (eu) has introduced reforms to the value added tax. Deemed supplies provisions are a sale that is split into two sales: Vat rules dictate that certain transactions which would not otherwise be treated as. Definition Of Deemed Supplies.

From www.slideserve.com

PPT Foreign Trade and India PowerPoint Presentation, free download Definition Of Deemed Supplies Since 1 july 2021, the european union (eu) has introduced reforms to the value added tax. Deemed supplies provisions are a sale that is split into two sales: deemed supplier rules for eu and non eu companies. what is deemed supply in vat? Vat rules dictate that certain transactions which would not otherwise be treated as supplies of. Definition Of Deemed Supplies.